The healthcare system is going to be more complex over time and providing accurate information of the patient is a major component in the revenue cycle. Therefore, it is vital to provide all the information of the patient accurately to the insurance after visiting the healthcare provider outside the network. This information is submitted in a piece of a document called “superbill.” Similarly, superbill in medical billing is important as it is available in the form of a receipt that includes the list of all the services.

So, a healthcare provider hands over all the billing process, including review, claim submission, and even AR- follow-up, to an expert medical biller . Here in this guide, we’ll explain more about the medical superbill, its types, and tips to submit it. Stay with us and learn how to create and submit the bill to the insurance company.

What is a Superbill?

A superbill in medical billing is a detailed bill or receipt in medical billing. It contains all services provided by a healthcare provider to a patient with the amount. These are commonly used in the process of billing healthcare services that are payable by the insurance company. It will encompass the date of service, the provider’s information, the patient’s details, the list of services rendered, including their respective medical codes, the cost of each service, and relevant diagnostic codes on the patient bill.

This document also serves to provide proof of visit and services rendered, which helps in payment from an insurance company. Patients can use medical bills to forward claims to insurance companies for payment or healthcare benefits. If you want to avoid all the hassle of submitting, reviewing, and creating a bill for healthcare insurance, you may hire some virtual staff to handle the process. For that, you may book a free consultation with MAVA Care where our virtual staff manages all the billing-related tasks.

Types of Superbills in Medical Billing

Medical bills are actually of two types. They may be prepared in the very same way each time in that the provider prepares these for every case. In submitting them, however, for payment to the payer – that is where it ends.

1. Client-Submitted Superbills

The patient receives the bill from the client. Here, the healthcare provider sends a copy of the patient’s bill to the patient. The patient then acts by contacting their insurance plan and submitting the claim for reimbursement for the costs they paid.

2. Clinician-Submitted Superbills

Clinicians, on the other hand, issue medical bills. If that is the case, the healthcare provider sends a bill of the patient to the insurance. The psychiatrist makes superbill reimbursement easy for a patient.

Main Components of Superbill

You might think, which types of information are listed on a superbill? Here is the main information mentioned below necessary for creating a medical bill for health. These include:

1. Patient Information

Here are the details that help the insurance company identify you:

- Your full name

- Where you live (address)

- When you were born

- Your phone number

- Any special ID number the insurance company might want

These details help make sure the insurance company knows who is getting the medical service and how to reach you if they need more information.

2. Provider Information

The provider section of a superbill in medical billing is like a complete ID card for the medical professional who treats you. It includes:

1. Provider’s Full Name

2. National Provider Identifier (NPI)

3. Office Location

4. Contact Information

5. Signature

This information helps insurance companies verify the medical service, ensure it’s from a legitimate healthcare professional, and process your claim correctly.

3. Visit Information

The information in a medical bill captures all the details of your visit. This section includes the date of service, location (doctor’s office, hospital, telehealth platform), and type of service (office visit, consultation, physical therapy, specialist exam).

Additionally, the bill for healthcare also outlines the reason for your visit, your chief complaint or symptoms, and the encounter type, such as new patient, follow-up, and routine. It helps insurance companies understand the medical necessity of the service and process your claim correctly, giving you a complete picture of the healthcare encounter.

How Does Superbill Work?

The superbill in medical billing is given to a patient after they see a healthcare professional. Then, the patient uses the bill to submit a claim to their insurance. Especially when the healthcare provider is out of network, so it goes like this:

- The healthcare provider records the appointment details, including diagnosis and treatments. Then, they give a document, such as a medical bill, that captures the visit.

- The patient gets the medical bill, which has all the codes and prices for that visit.

- The patient gives the medical bill to the insurance service provider to get reimbursed for the expenses. The insurance company may submit this information through mail, the internet, or facsimile, depending on their preference.

- The insurance company reviews the medical bill and calculates the reimbursement. According to the patient’s policy terms, including deductible amounts, copayment rates, and coverage limits.

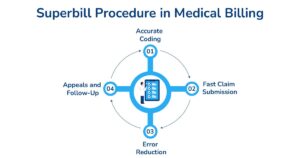

Superbill Procedure in Medical Billing

Managing the bills for patients is tough, especially with many patients and insurance companies. Medical billing services help healthcare providers manage medical bills; here’s how:

1-Accurate Coding

Medical billing service providers have coders who ensure the diagnosis and procedure codes in the super billing are accurate and stay that way. Proper coding reduces claim denials and increases reimbursements.

2-Fast Claim Submission

After the bill is created, medical billing services can handle the patient’s submission process and get the claim to the insurance company on time.

3-Error Reduction

By not being in the billing process at all, providers can avoid mistakes that come with medical bill preparation, such as wrong codes, lack of information, and poor documentation that can cause claim and payment delays.

4-Appeals and Follow-Up

There are times when a claim is rejected for one reason or another, or the payment is less than expected. In these cases, billing service companies step in and manage the appeal process, including follow-up with the payers.

Importance of Superbill in Healthcare Insurance

Generally, providers who are out of network provide the patients with a billing process, upon which it is incumbent to pay for the treatment received. Still, once the patient enjoys out-of-network benefits the medical bills work as an essential to activate the usage.

After that, upon treating the patient, it presents a bill to its health insurance that pays it some percentage for the amount in question. Benefit limits, amounts, out-of-network superbills deductibles, and out-of-pocket maximums are examples of out-of-network restrictions seen in the majority of plans.

It quite varies between plans and is an important cue to consumers to know their health plan before making treatment decisions also note that not all out-of-network services will require prior authorization.

How To Submit a Superbill to Insurance?

First, get a bill from your doctor that shows what services you received. Make sure the bill has your name, the doctor’s name, the date you were seen, and the exact codes for your services. Check your insurance plan to see if they will pay for out-of-network services. Keep a copy for yourself.

Next, send the bill to your insurance company. Include any extra papers they might need like a form with your info or proof you already paid the bill. After you send everything, watch for their response. If you don’t hear back in a few weeks, call your insurance company and ask about the status of your claim.

Concluding Remarks

A superbill in medical billing is like a special receipt that connects three key factors including the provider, the patient, and the insurance company. It helps patients get money back for medical services they receive outside their insurance network. When a medical bill is done right, it provides all the important details an insurance company needs to understand and pay for the medical service.

Medical billing services work hard to make these bills as accurate as possible; this helps everything move more smoothly. You may contact MAVA Care, a medical billing company, for smooth and error-free billing services. Our skilled medical billers handle all your billing-related tasks so that you can enhance your practice revenue shortly.

FAQ’s

What is another name for Superbill?

Other names for such a bill are “Charge Slips,” “Encounter Forms,” or “Fee Tickets.” They are pre-printed documents that are meant to record the fees from a patient visit that are necessary to bill insurance companies. However, these documents can sometimes be confusing.

What does Superbill require?

The following information regarding the encounter should be on the medical bill:

- Date of Service

- Fee for Each Service Date

- Diagnostic Code (DX)

How to get reimbursement through Superbill?

To get reimbursement through a patient bill, first obtain an invoice from your healthcare provider that includes diagnostic and procedure codes. Then, submit this patient bill to your insurance company for potential out-of-network reimbursement.

Is there any difference between statement and superbill?

Yes, there’s a key difference between a medical statement and a patient bill. A statement is a basic billing document showing charges and payments. At the same time, a patient bill is an invoice containing specific diagnostic and procedural codes for insurance companies for out-of-network reimbursement claims.

How do I generate the superbill?

To generate a medical bill, request an invoice from your healthcare provider that includes specific medical codes (CPT, ICD-10), patient and provider information, date of service, and total charges.